Business Insurance in and around Plymouth

Calling all small business owners of Plymouth!

No funny business here

Help Prepare Your Business For The Unexpected.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for those you love. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, extra liability coverage and errors and omissions liability.

Calling all small business owners of Plymouth!

No funny business here

Small Business Insurance You Can Count On

At State Farm, apply for the great coverage you may need for your business, whether it's a cosmetic store, a farm supply store or a pet store. Agent Allison Kara is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

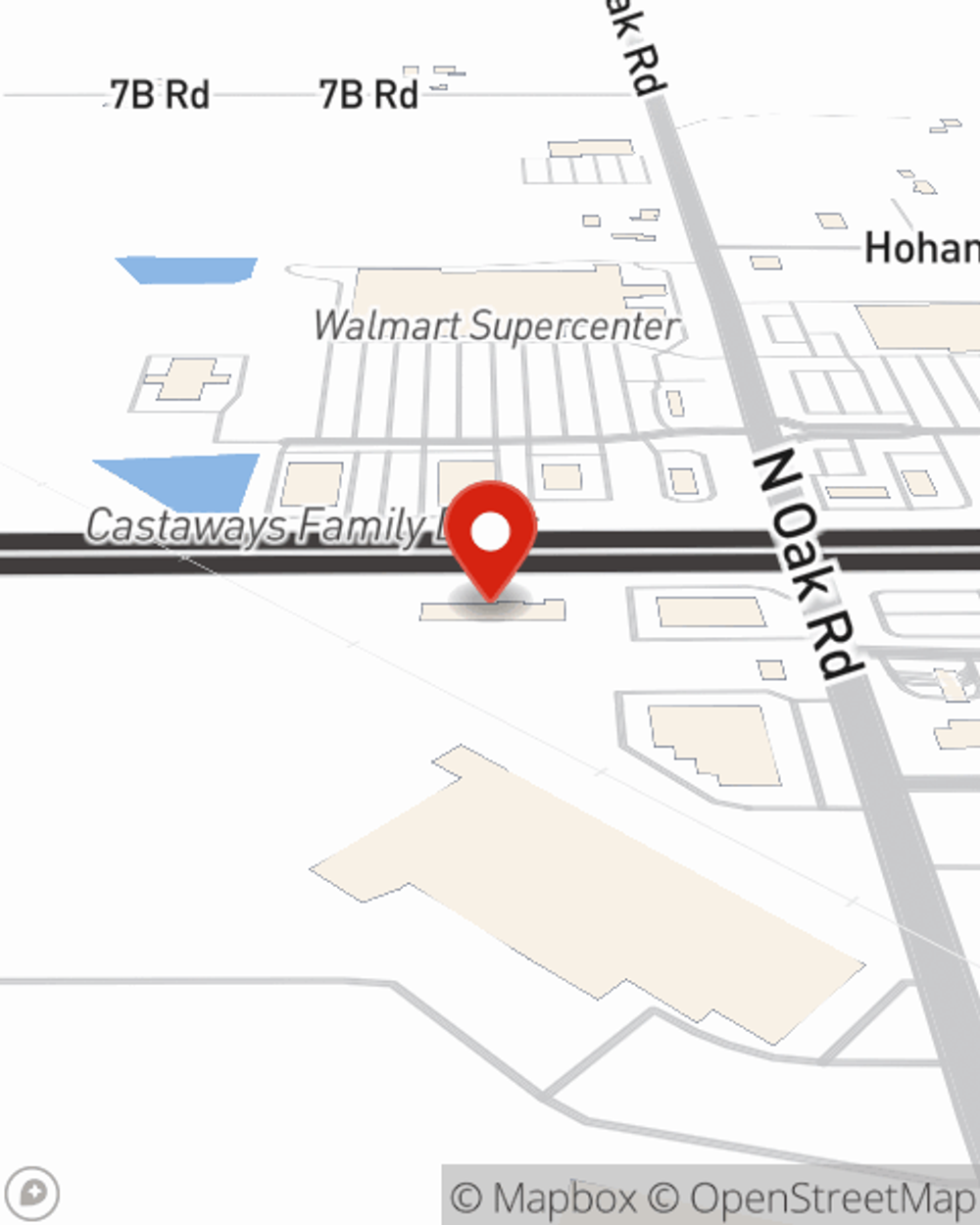

Ready to talk through the business insurance options that may be right for you? Get in touch with agent Allison Kara's office to get started!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Allison Kara

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.